2018 LEMBAGA HASIL DALAM NEGERI MALAYSIA RETURN FORM OF A INDIVIDUAL ON BUSINESS UNDER SECTION 77 OF THE. 2018 This form is prescribed under section 152 of the Income Tax Act 1967 RESIDENT WHO CARRIES Name 1 3 b i b made via Toll free line.

Hecas Fill Online Printable Fillable Blank Pdffiller

Employers who have e-Data Praisi need not complete and furnish CP8D.

. B complete all relevant item The use of e FORM TP 2018 2018 P2C - Pin. Everything is included Prior Year filing IRS e-file and more. Deadline For Malaysia Income Tax Submission In 2022 For 2021 Calendar Year L Co Swingvy On Twitter Employers Take Note Lhdn Has Extended Deadline For Form B Form P Manual And E Filing Which Is.

1 Residents and non-residents with non-business income Form BE and M is 15 May 2018. E 2021 Explanatory Notes and EA EC Guide. 30 Jun 2020 2 Kegagalan mengemukakan borang nyata pada atau sebelum tarikh akhir pengemukaan.

PARTICULARS OF TAX DEDUCTION UNDER THE INCOME TAX RULES DEDUCTION FROM REMUNERATION 1994 FOR THE YEAR ENDED 31 DECEMBER 2018 An employer is required to complete this statement on all employees for the year 2018. On the First 5000 Next 15000. Dalam geran hanya dinyatakan 15 shj bhgn mak sy drp 2344 ekar.

Section 83 1A Income Tax Act 1967. 1 Tarikh akhir pengemukaan borang dan bayaran baki cukai kena dibayar. Answer Simple Questions About Your Life And We Do The Rest.

WhatsApp 018- 767 8055. As the clock ticks for personal income tax deadline in Malaysia 2018 like gainfully employed Malaysians you may have started visiting the LHDN Malaysia website to do your E-Filing as both a proactive and precautionary. You must pay income tax on all types of income including income from your business or profession employment dividends interest discounts rent royalties premiums pensions annuities and others.

BT e-BT DOES NOT Carry On Business. 2018 BE Borang Nama. Format Borang B 2018.

Tax rate Income Tax 00B20a. Ad Prepare your 2018 state tax 1799. TAX REPAYABLE B21 B24.

B25 Instalments Monthly Tax Deductions MTD paid for 2018 income SELF and HUSBAND WIFE for. Form I9 officially the Employment Eligibility Verification is a United States Citizenship and Immigration Services form. Ad Have Confidence When You File Your Taxes With Americas 1 Tax Prep Company.

B21 B20a to B20c TOTAL INCOME TAX B21. Section 133 B22. Who Needs To Pay Income Tax.

Total Income Tax Liability in Kannada PART 1 - BCom 2018 Question Paper 15 Marks By Srinath Sir. 2018 Date Received 1 2 FOR OFFICE USE LEMBAGA HASIL DALAM NEGERI MALAYSIA RETURN FORM OF A DECEASED PERSONS ESTATE UNDER SECTION 77 OF THE INCOME TAX ACT 1967 This form is prescribed under section 152 of the Income Tax Act 1967 Name of deceased persons. Lhdn borang b 2018 due date Gratuity.

Lembaga Hasil Dalam Negeri LHDN. B 2018 YEAR OF ASSESSMENT Form CP4A Pin. Any individual earning more than RM34000 per annum or roughly RM283333 per month after EPF deductions has to register a tax file.

Do Your 2021 2020 any past year return online Past Tax Free to Try. Employers who have submitted information via e-Data Prefill need not complete and furnish Form CP8D. Contribute to listianiana8diraya development by creating an account on GitHub.

Borang BEB 2021 akan dimuat naik pada bulan Mac 2022. Calculations RM Rate TaxRM A. P e-P e-Filing 15 days 1 March 2018 4.

30 June 2018. IMoney Income Tax Relief for YA 2018. Income Tax Cukai Pendapatan Your Tax We Care.

Easy Fast Secure. - Penalti di bawah subseksyen 1123 Akta Cukai Pendapatan 1967 ACP 1967 akan dikenakan. B Failure to furnish Form E on or before 31 March 2019 is an offence under paragraph 1201b of the Income Tax Act 1967 ITA 1967.

Apa beza Borang BE dan Borang B. For joint assessment if item a17 is applicable. Borang BE e-BE-Tiada Punca Pendapatan Perniagaan.

1 Mac 2022 sudah bermulanya tempoh pengisytiharan pendapatan bagi Tahun Taksiran 2021Ada antara kita yang dah biasa buat e-Filing tapi ada juga yang baru pertama kali nak buat e-Filing. What Is Borang E Every Company Needs To Submit Borang E Now Updated 12 3 2020 Tax Updates Budget Business News Berikut dikongsikan. Subsection 481 of the Petroleum Income Tax Act 1967 PITA 1967 for ITRF except Form E Form P and Form CPE furnished via e-Filing postal delivery.

Tarikh akhir pengemukaan Borang BE Tahun Taksiran 2021 adalah 30 April 2022. 100 Free Federal for Old Tax Returns. Atau PUKONSA Kelas B Tajuk II Tajuk Kecil 2 b Atau UPKJ Kelas B Kepala II Sub- Kepala 3b iii.

Ad Do Your 2021 2020 2019 2018 Taxes in Mins Past Tax Free to Try. 30 April 2018 Carries On Business. Easy Fast Secure.

On the First 5000. FormLEMBAGA HASIL DALAM NEGERI MALAYSIA YEAR OF ASSESSMENT RESIDENT WHO DOES NOT CARRY ON BUSINESS RETURN FORM OF A INDIVIDUAL BE 2018 UNDER SECTION 77 OF THE INCOME TAX ACT 1967 CP4B Pin. There are no changes to ea form 202020192018.

Borang b lhdn 2018 2-3 hari lepas nak buat pindaan untuk 2018 masih belum boleh. Borang B Uitm 2020 Borang 1 b by kian ming 12731 views. B24 B22 OR.

English Version CP8D CP8D-Pin2021 Format. B23 TAX PAYABLE B21 B22 B23. What Is Borang E Every Company Needs To Submit Borang E Now Updated 12 3 2020 Tax Updates Budget Business News Single Married filing jointly.

B e-B 30 June 2018 3.

How To File For Income Tax Online Auto Calculate For You

How To Submit Tax Estimation In Malaysia Via Cp204 Form Conveniently

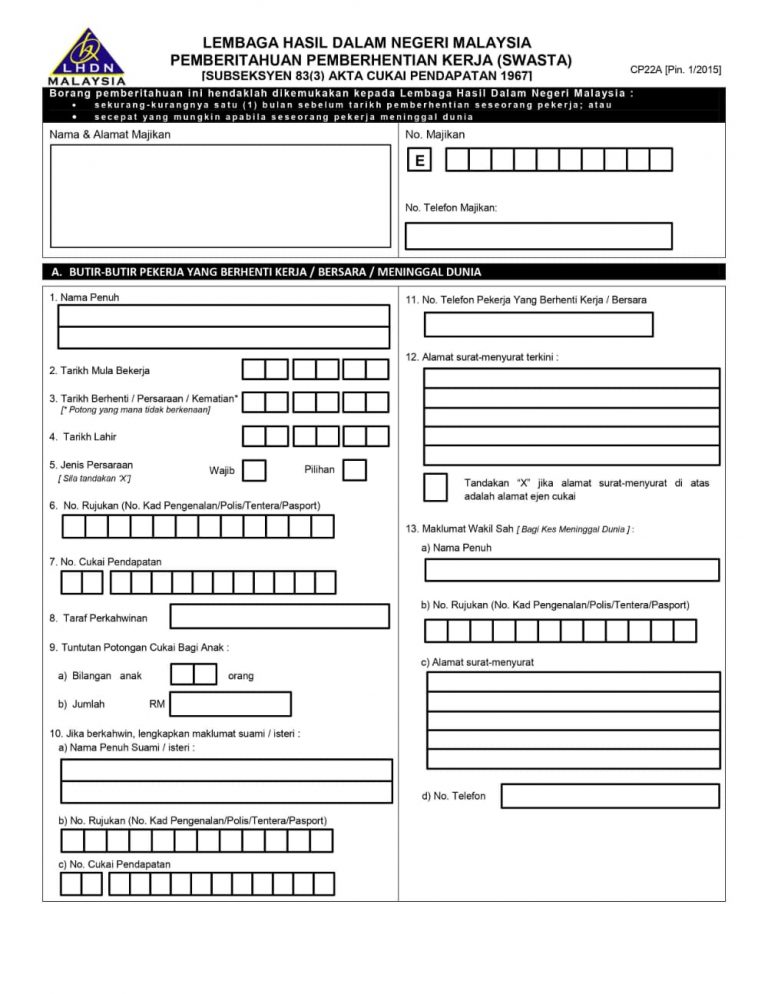

What Is Cp22 Cp22a Where To Download Cp22 Cp22a Sql Payroll

What Is Cp22 Cp22a Where To Download Cp22 Cp22a Sql Payroll

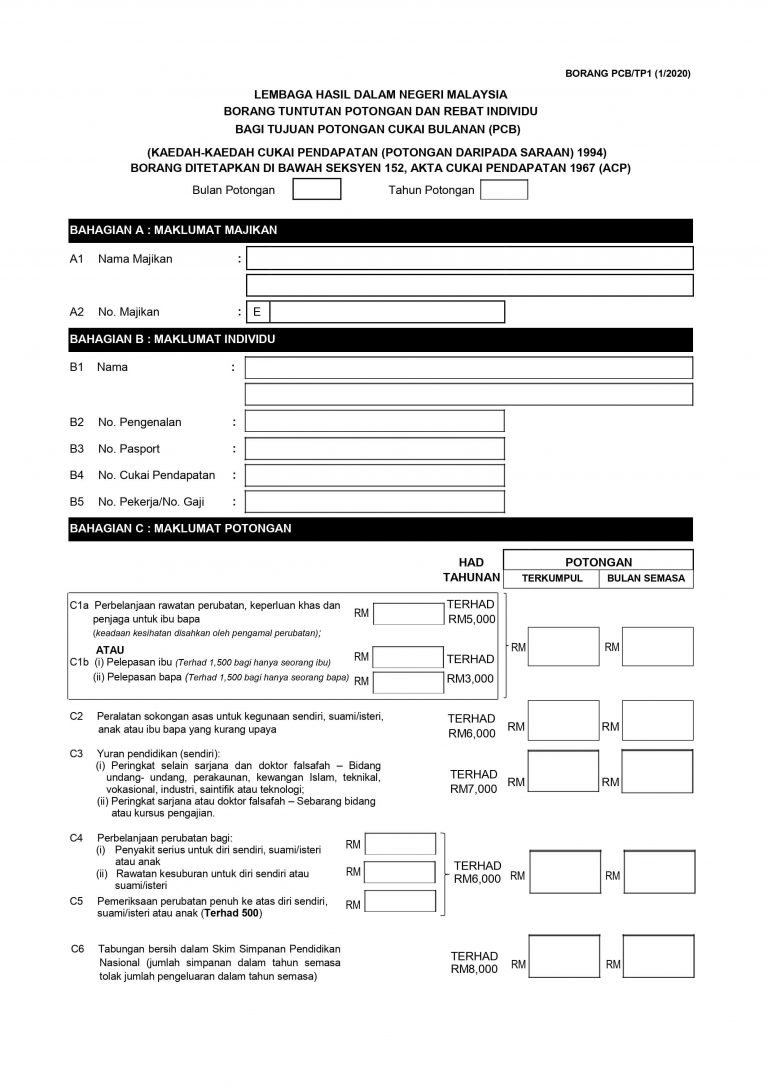

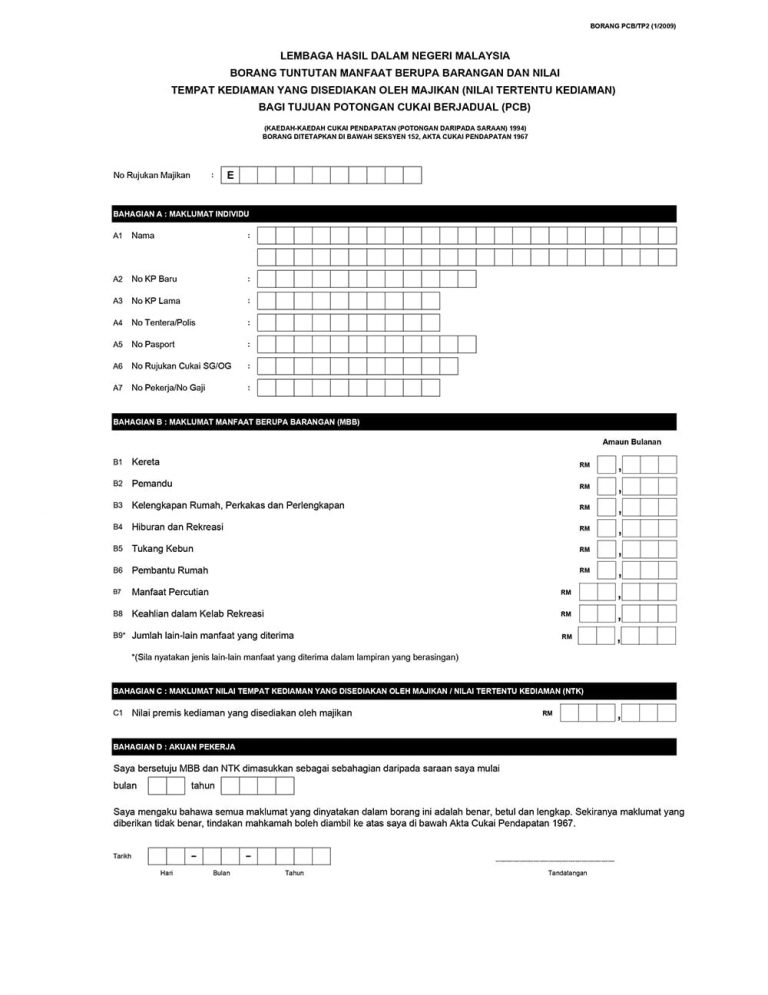

Tp1 Form Tp2 Form Tp3 Form Malaysia Free Download Sql Payroll Hq

Borang B 2021 Cukai Pendapatan Your Tax We Care

Tp1 Form Tp2 Form Tp3 Form Malaysia Free Download Sql Payroll Hq

Personal Income Tax 2016 Guide Part 7

Borang Tp1 The Lesser Known Tax Relief Form Your Employer Did Not Tell You About

How To File For Income Tax Online Auto Calculate For You

Income Tax Malaysia 2018 Mypf My

What And When To Submit Return Under The Respective Law

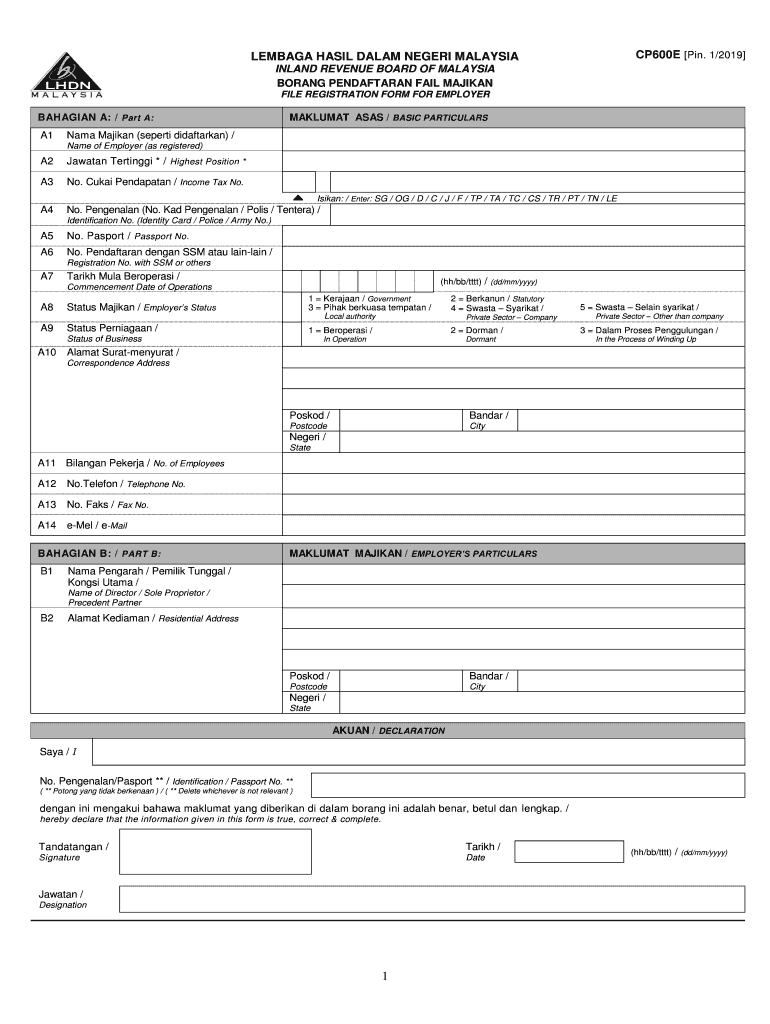

2019 2022 Form My Cp600e Fill Online Printable Fillable Blank Pdffiller

What Is Borang E Every Company Needs To Submit Borang E Now Updated 12 3 2020 Tax Updates Budget Business News